Inflation Surge in Japan and UK Impacts Global Economy Dynamics

As the global economy navigates uncertain waters in 2025, inflationary pressures in key regions like Japan and the United Kingdom are drawing particular attention. Economic analysts and policymakers alike are keenly observing how these changes will impact global economic dynamics, given the interconnected nature of today's international markets. This blog post delves into the causes, impacts, and broader implications of the recent surge in inflation in these economic powerhouses.

Understanding the Recent Inflation Trends

The trend of rising inflation in Japan and the UK has roots in both domestic and international factors. Japan, which historically experienced low inflation levels, is now witnessing an unexpected surge. This shift can be attributed to higher import costs driven by fluctuating global commodity prices and a weaker yen.

In contrast, the United Kingdom has been grappling with inflation due to its post-Brexit economic realignments. The complexities of new trade agreements, coupled with ongoing supply chain disruptions, have placed added pressure on consumer prices. Both countries are encountering higher energy costs, further fanning the flames of inflation.

The Causes Behind Japan's Inflation Surge

Japan's inflationary rise is significantly attributed to external market factors. The reliance on imported goods, especially energy, has made Japan vulnerable to global price changes. Supply chain bottlenecks, a direct fallout from the pandemic-era disruptions, have compounded these challenges.

Moreover, Japan's accommodative monetary policies, aimed at stimulating growth amidst economic headwinds, have inadvertently elevated inflation levels. This policy landscape, mixed with geopolitical tensions affecting trade, has led to a precarious economic environment where inflationary concerns overshadow growth prospects.

The UK's Inflation Puzzle

The United Kingdom faces its own set of challenges driving inflation. Brexit has led to new trade barriers, increasing the cost of goods and services. Additionally, labor shortages post-pandemic have resulted in wage hikes, contributing to rising production costs which are, in turn, passed on to consumers.

Adding to the complexity, the UK is dealing with significant shifts in its economic structure. The pivot towards a greener economy has necessitated investments and changes in energy infrastructure, impacting energy prices and therefore, overall inflation. These factors combined present a challenging landscape for policymakers who must balance growth and inflation control.

Global Repercussions and Economic Dynamics

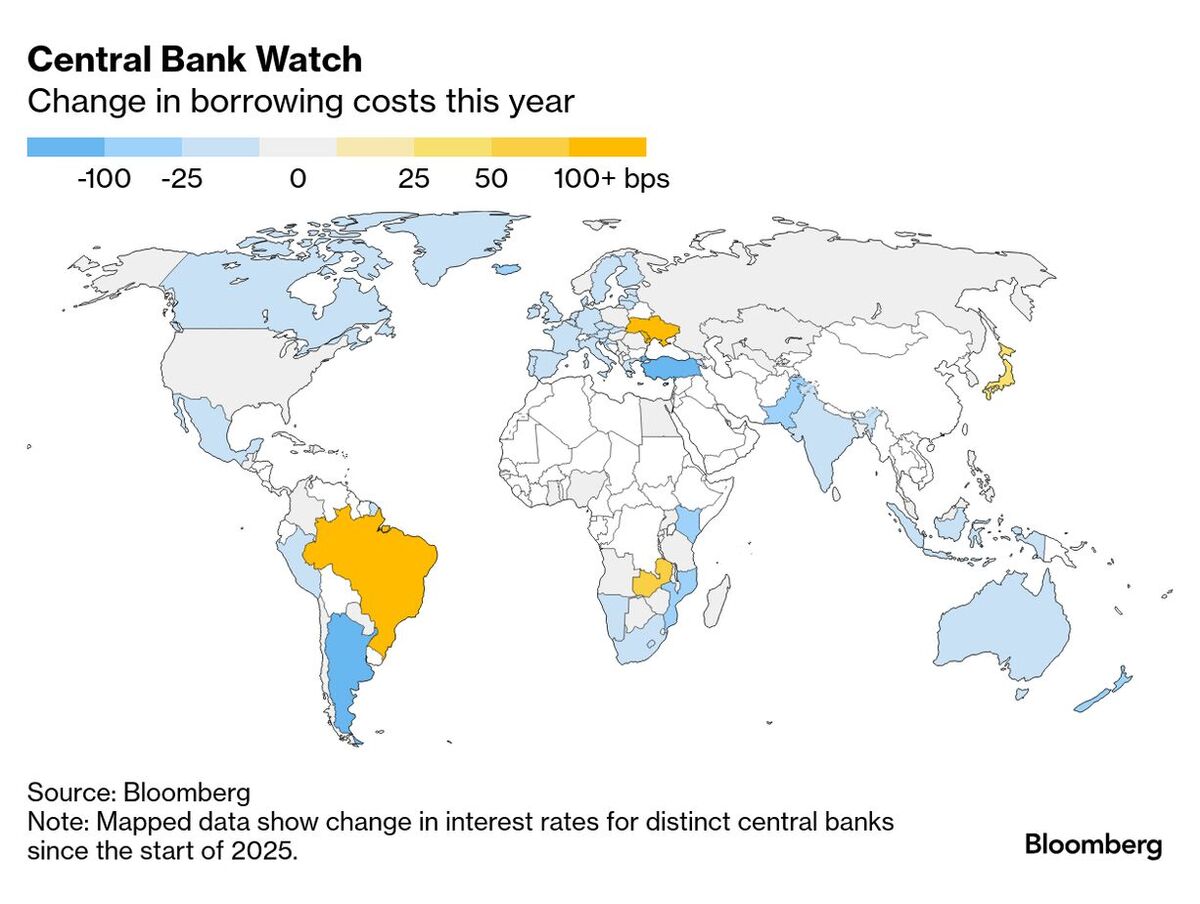

The inflationary trends in Japan and the UK are not isolated phenomena. In today's globalized world, economic shifts in one region can have cascading effects worldwide. Investors are wary of these trends, as higher inflation typically leads to tighter monetary policies, affecting global capital flows.

For emerging economies dependent on foreign investments, these global shifts could mean increased borrowing costs. The ripple effect of inflation may lead to subdued growth prospects, necessitating strategic adjustments in economic planning and policy making across the globe.

How Industries are Adapting

Various industries are making pivotal adjustments to withstand the inflationary climate. Manufacturing sectors in both Japan and the UK are innovating supply chain strategies to mitigate the impact of rising costs. This includes nearshoring production and leveraging technology to improve efficiency and reduce dependency on volatile external markets.

For consumers, the ride is likely to be rocky. Businesses may resort to price adjustments which could translate into higher living costs, necessitating changes in consumption patterns. On the brighter side, this could spur innovations and demand for cost-effective solutions, driving industry transformation.

Policy Responses and Economic Strategies

Governments and central banks in both Japan and the UK are wrestling with finding a balance between curbing inflation and sustaining economic growth. Central banks are inching towards tighter monetary policies to restrain inflation. However, these measures come with the risk of cooling off economic activity.

Fiscal policies aimed at bolstering sectors most impacted by inflation are also under consideration. An agile policy response, tailored to quickly changing economic conditions, will be crucial in maneuvering through this challenging economic period.

The Road Ahead

Looking forward, the importance of international cooperation cannot be overstated. As nations grapple with the twin challenges of inflation and economic stability, collaborative measures such as aligning trade policies and promoting sustainable development initiatives could provide a pathway toward balanced growth.

Adaptation and resilience-building will become cornerstones for businesses and economies alike. For policymakers, understanding that while solutions may be localized, their implications are globally significant, will be vital in steering through inflationary tides.

Conclusion: A Call to Action

In sum, the inflation surge in Japan and the UK is a critical development with far-reaching implications. As the global economy is a tapestry of interconnected threads, shifts in these significant economies necessitate a recalibration of strategies and frameworks worldwide.

Stakeholders from policymakers to businesses must pivot swiftly to navigate these changes. By embracing innovation, cooperation, and adaptive measures, there lies a potential not just to weather this storm but to emerge stronger, fostering a resilient global economic landscape for the future.